990 part vii instructions

Form 990 Part VII Instructions⁚ A Comprehensive Guide

This comprehensive guide will walk you through the intricacies of Form 990 Part VII, providing clear explanations and practical insights into reporting compensation for officers, directors, trustees, key employees, and independent contractors. We’ll delve into essential definitions, reporting requirements, and common questions to ensure a smooth and accurate filing process.

Understanding the Purpose and Importance of Part VII

Form 990 Part VII is a critical section of the IRS Form 990 that delves into the compensation and financial dealings of a nonprofit organization’s leadership and key personnel. It serves as a transparent disclosure of the organization’s compensation practices, ensuring accountability and public trust. The information provided in Part VII sheds light on the financial arrangements for officers, directors, trustees, key employees, and highly compensated employees, as well as independent contractors. By meticulously completing this section, nonprofits demonstrate their commitment to responsible financial management and ethical practices, bolstering public confidence in their operations.

Who Must Complete Part VII?

The obligation to complete Form 990 Part VII rests on the shoulders of all tax-exempt organizations that are required to file Form 990. This includes organizations that fall under sections 501(c), 527, or 4947(a)(1) of the Internal Revenue Code. However, it’s important to note that certain smaller organizations may be eligible for a simplified Form 990-EZ, which does not require the completion of Part VII. The specific requirements for Form 990 or Form 990-EZ are determined by the organization’s gross receipts, assets, and other factors. To determine which form is appropriate, consult the IRS instructions for Form 990 or the Form 990-EZ instructions, or seek guidance from a qualified tax professional.

Key Definitions⁚ Related Organizations and Control

Understanding the concepts of “related organizations” and “control” is crucial for accurately completing Form 990 Part VII. A related organization is defined as an entity that has a significant relationship with the filing organization, often involving shared control, financial transactions, or common governance. The IRS provides specific criteria to identify related organizations, including shared officers, directors, or trustees, significant financial transactions, or substantial control over the organization’s operations. The level of control exerted by one organization over another is also a key consideration. “Control” can be exercised through voting power, ownership interests, or the ability to direct the organization’s activities. For instance, if a donor has a significant ownership interest in a for-profit entity and that entity provides substantial services to the nonprofit organization, the for-profit entity may be considered a related organization.

Reporting Officer, Director, and Trustee Information

Form 990 Part VII, Section A, mandates the reporting of detailed information about officers, directors, and trustees, including their names, positions, and compensation. The information should be presented in a specific order, beginning with trustees or directors, followed by officers, and then key employees and highly compensated employees. It is crucial to accurately identify and report the individuals serving in these roles during the tax year. The reporting period for compensation extends to the entire tax year, even if an individual served for only part of the year. For those who served for a portion of the year, the dates of service should be clearly indicated. Furthermore, any changes in positions held by individuals within the organization should also be reflected in the reporting.

Compensation Reporting Requirements

Form 990 Part VII demands a comprehensive reporting of compensation for officers, directors, trustees, key employees, and highly compensated employees. The reporting should include all forms of compensation received during the tax year, such as salaries, bonuses, benefits, and other forms of remuneration. It is crucial to note that reportable compensation includes amounts reported in Form 1099-MISC, box 6 (medical and healthcare payments). However, it is essential to differentiate between base pay and deferrals to retirement plans like 401(k) and 403(b), as these should be reported separately. The instructions provide detailed guidance on categorizing compensation appropriately. Remember, it is imperative to accurately report all compensation received, ensuring clarity and transparency in your organization’s financial reporting.

Reporting Independent Contractors

Form 990 Part VII, Section B requires organizations to report information about independent contractors who received compensation exceeding $100,000 during the tax year. The reporting should include the independent contractor’s name, business or trade name, principal business activity, and total compensation received. If your organization has no independent contractors meeting this threshold, you should clearly indicate “none” in the designated space. It is crucial to understand that this reporting requirement is not limited to individuals. Organizations that have engaged independent contractor entities, such as partnerships or corporations, should also report their information. Failing to report this information accurately could lead to penalties and scrutiny from the IRS, so ensure meticulous attention to detail in this section.

Key Employee and Highly Compensated Employee Reporting

Form 990 Part VII, Section A mandates reporting information for both key employees and highly compensated employees. A key employee is defined as an individual who holds specific positions within the organization, such as an officer, director, or trustee. Highly compensated employees are those who receive annual compensation exceeding a certain threshold, which is adjusted annually by the IRS. Reporting for these individuals includes their name, position, compensation, and any benefits received. It is important to note that while both key employees and highly compensated employees must be reported, there is no overlap. An individual can be either a key employee or a highly compensated employee, but not both. This reporting requirement is crucial for ensuring transparency and accountability in the use of organizational resources, and failure to comply can result in penalties and scrutiny from the IRS.

Completing Schedule J⁚ Reportable Compensation

Schedule J (Form 990) serves as a detailed breakdown of reportable compensation for individuals listed on Form 990 Part VII, Section A. This schedule requires organizations to report specific types of compensation, including salaries, bonuses, deferred compensation, and other forms of remuneration. It is crucial to ensure accuracy and completeness when completing Schedule J, as any discrepancies can raise questions and potentially lead to audits. The instructions for Schedule J provide clear guidance on which types of compensation are reportable and how to properly categorize them. This includes details on how to report compensation for part-year service, severance payments, and other unique circumstances. By diligently completing Schedule J, organizations can demonstrate transparency and accountability regarding the allocation and use of financial resources.

Additional Reporting Requirements

Form 990 Part VII goes beyond simply listing compensation details. It also includes additional reporting requirements that are essential for maintaining transparency and compliance. These requirements vary depending on the organization’s specific circumstances and may involve disclosures related to foreign bank accounts, prohibited tax shelter transactions, or unrelated business income. If your organization has engaged in any of these activities, you must complete the relevant sections of Part VII and potentially file supplemental forms, such as Form 990-T or Form 8886-T. By adhering to these additional reporting requirements, you ensure that your organization’s financial activities are fully documented and comply with IRS regulations.

Filing Form 4720

In certain situations, organizations are required to complete and file Form 4720, a document that reports information related to private foundations and their activities. This requirement arises when an organization has answered “Yes” to a specific question on Form 990, Part IV, which pertains to the presence of a related person or a controlled entity connected to a donor or donor advisor. The related person designation encompasses family members of the donor or donor advisor, while a controlled entity refers to any entity that falls under the definition of section 4958(f) of the Internal Revenue Code. If your organization has a related person or controlled entity connected to a donor or donor advisor, you must complete Form 4720 and submit it alongside your Form 990.

Understanding the 2019 Form 990 Instructions

The 2019 Form 990 instructions introduced a notable change in the reporting of compensation. Previously, the instructions required filers to list individuals in Part VII in a specific order, starting with trustees or directors, followed by officers, then key employees, and finally, highly compensated employees. However, the 2019 instructions have shifted the focus to reporting individuals based on their compensation level, requiring filers to list them in descending order from highest to lowest compensation. This change emphasizes the importance of accurately reporting compensation amounts for all individuals listed in Part VII.

Resources for Completing Part VII

Navigating the complexities of Form 990 Part VII can be a daunting task, but numerous resources are available to guide you through the process. The IRS website provides comprehensive instructions, definitions, and FAQs to clarify specific requirements. Additionally, organizations like the National Council of Nonprofits (NCCN) offer educational materials, webinars, and workshops to assist nonprofits in understanding and complying with Form 990 reporting obligations. Consult with qualified tax professionals or seek guidance from nonprofit organizations specializing in Form 990 preparation to ensure accurate and compliant reporting.

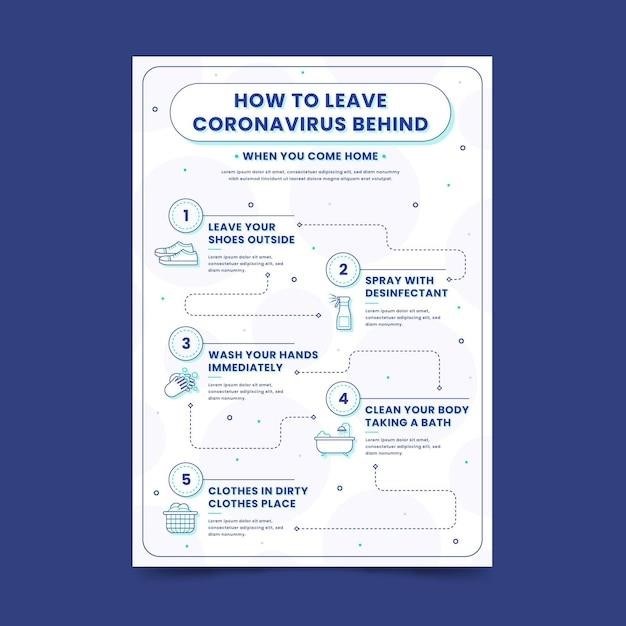

Sample Form 990 Part VII

Visualizing the completed Form 990 Part VII can be incredibly helpful in understanding the layout and data requirements. The IRS provides sample forms on its website, offering a clear illustration of how to organize and input information for each section. These samples showcase proper formatting, terminology, and the expected level of detail for each field. Reviewing these sample forms allows you to gain a comprehensive understanding of the structure and content expected for your own organization’s Form 990 Part VII filing.

Frequently Asked Questions about Part VII

Navigating the complexities of Form 990 Part VII often raises questions for filers. Common inquiries include⁚

- Who must complete Part VII? All tax-exempt organizations required to file Form 990, including those with unrelated business income, must complete Part VII.

- How are related organizations determined? The instructions for Form 990 define related organizations and control, helping you identify entities that must be reported on Schedule R.

- What types of compensation are reportable? Reportable compensation includes base pay, bonuses, deferred compensation, and benefits. Refer to the Form 990 instructions and glossary for a comprehensive list.

- What if an organization has no independent contractors? If your organization has no independent contractors receiving over $100,000, simply write “None” in the designated space.

The IRS website, as well as online tax resources, often provide detailed FAQs and guidance on Form 990 Part VII.

Leave a Reply

You must be logged in to post a comment.